Is The LNG Boom Dead?

viaIs The LNG Boom Dead? | Seeking Alpha.

Summary

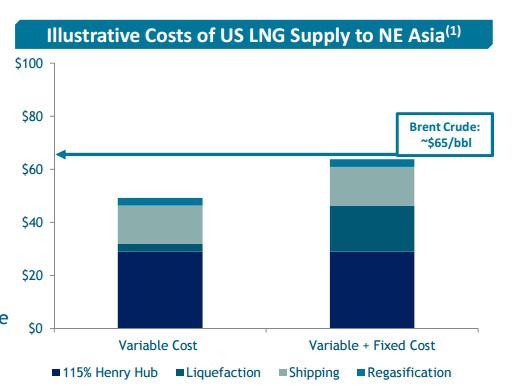

- North American LNG will struggle to be competitive with Brent Crude under $65.

- Asia spot price for Natural Gas has dropped alarmingly.

- Many LNG projects still in planning are being cancelled or delayed.

Last year, global natural gas companies, particularly the LNG shippers, were very bullish about the future. A CEO of one of the newer, independent LNG charterers quipped that the LNG shipping industry hadn’t seen such great tailwinds since the 1950s. In a company presentation, another LNG shipper proclaimed we were entering the ‘Golden Age of LNG.’

The thesis was this: Global demand for gas was not only growing, but the centers of demand (mostly Europe and East Asia) had little gas of their own. So, a whole armada of new LNG tankers would be needed to meet demand, with North America and Australia seeming to be the primary sources of supply growth.

Then crude oil prices came crashing down, and this made it difficult for North American and Australian LNG to compete with oil-associated Mideast LNG, whose prices are linked to Brent Crude.

Courtesy of GasLog Investor Relations (analyst day presentation).

Unsurprisingly, many new LNG plants under construction or in planning are either being delayed or cancelled. Petronas, the Malaysian national oil company, has delayed its final investment decision for an LNG facility in the Pacific Northwest. Also in the US, final investment decisions for Lake Charles LNG have been pushed back to 2016. Royal Dutch Shell (NYSE: RDS.A) recently cancelled its Arrow LNG project in Australia.

So, is the age of LNG dead? Or is it just delayed? And what does this mean for investors? This article will attempt to answer those two questions.

Moving forward

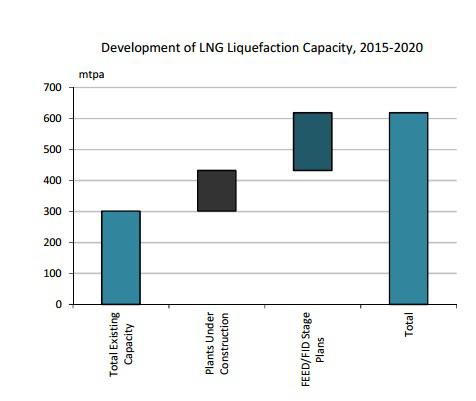

Courtesy of GasLog Investor Relations

Above is a chart of name-plate processing capacity of existing LNG plants, facilities under construction, and projects in planning. The bar on the far right best represents expectations in mid-2014, before the price of crude oil crashed. The middle bar, ‘plants under construction,’ plus ‘total existing capacity,’ I believe best represents what LNG shipping demand will look like in a few years. I believe that most LNG projects already under construction are going to be finished eventually, but the ones in planning will be either delayed or cancelled altogether. Demand for LNG chartering will be constrained by the supply from LNG terminals. While medium-term LNG demand may not be as great as we thought, there should still be some growth in LNG demand for the next few years.

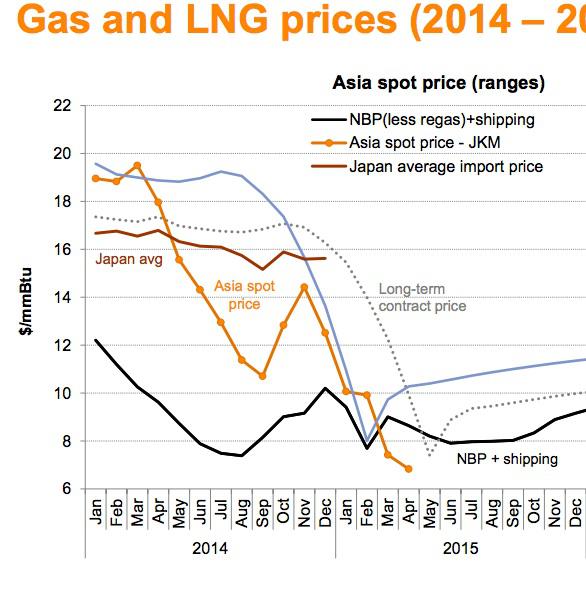

Courtesy of BG Group Investor Relations

Here’s one chart that should concern LNG bulls. Due to a mild winter, the spot price of gas in East Asia dipped to a multi-year low. With dry gas below $8 per mcfe, there is hardly any profit after liquification, transportation and regassification costs. Even the already-constructed LNG facilities need higher gas prices in East Asia. Fortunately for the LNG shippers, most producers supplying Asia are locked into long-term contracts, but these low prices could become a problem if they persist.

The good news is that gas consumption is expected to rise steadily. According to a study by BP, gas consumption will grow by 1.9% per year until 2035, and most experts agree that demand for LNG should grow even faster. While that ‘demand’ means nothing if the export facilities are not built, the long-term fundamentals are still there.

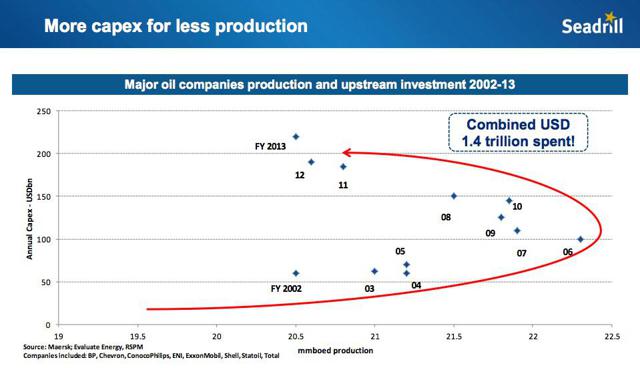

Courtesy of Seadrill Investor Relations

The good news is that crude oil will eventually have to go higher, and that this move will probably ‘rescue’ the bullish LNG thesis. Even when crude oil prices were high, costs for exploration and production were inflating because the remaining oil is increasingly hard to get at.

With oil prices so low today, many new, offshore projects are no longer profitable, and development activity is already slowing down everywhere. Even with today’s maintenance spending, production is expected to drop by 2.5% per year, according to Schlumberger (NYSE:SLB) CEO Paul Kibsgaard. That decline comes out to about two million barrels per day, which is also the approximate global spare capacity at this time. How long will it take for crude oil prices to rebound? That’s hard to say, but I do expect North American and Australian LNG to be more competitive in the future than they are today.

Conclusion

Those who were hoping for immediate gratification from LNG investments have surely been disappointed over the last year. The ‘Golden Age’ of LNG has been pushed away for a couple years. For the patient investor, my one long-term recommendation for this sector is GasLog (NYSE:GLOG). GasLog is an independent LNG shipper and, importantly, many of its new-build ships do not come available until 2016 or 2017. Hopefully things will be better by then. As a small company with an ambitious growth plan, I believe GasLog is the best-situated of the LNG shippers.

Read more on alternative investing »